2025 Maximum Social Security Income. This amount is known as the. The $ 22,924 social security bonus most retirees completely overlook if you're like most americans, you're a few years (or more) behind on your retirement.

For 2025, the amount of earnings that will have no effect on eligibility or benefits for ssi beneficiaries who are students under age 22 is $9,230 a year. The maximum $4,873 monthly benefit in 2025 is only paid to individuals who wait until age 70 to retire.

What Is The Social Security Earnings Limit For 2025 Amii Lynsey, The rules of the internal revenue service dictate that many who receive social security benefits will have to pay an income tax on that money. In 2025, the maximum social security benefit is $4,873 per month.

Limit For Maximum Social Security Tax 2025 Financial Samurai, Be under full retirement age for all of 2025, you are considered retired in any month that your earnings are $1,860 or less and you did not perform substantial services. If you retire at your full retirement age (fra) this year, your.

Social Security Wage Base 2025 [Updated for 2025] UZIO Inc, Maximum taxable earnings ( en español) if you are working, there is a limit on the amount of your earnings that is taxed by social security. The maximum benefit for a worker who claims social security at full retirement age (fra) in 2025 will be $3,822 a month, up from $3,627 in 2025.

![Social Security Wage Base 2025 [Updated for 2025] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023-1024x791.png)

2025 Social Security, PBGC amounts and projected covered compensation, The rules of the internal revenue service dictate that many who receive social security benefits will have to pay an income tax on that money. The maximum social security benefit at full retirement age is $3,822 per month in 2025.it’s $4,873 per month in 2025 if retiring at age 70 and $2,710 if retiring at age 62.

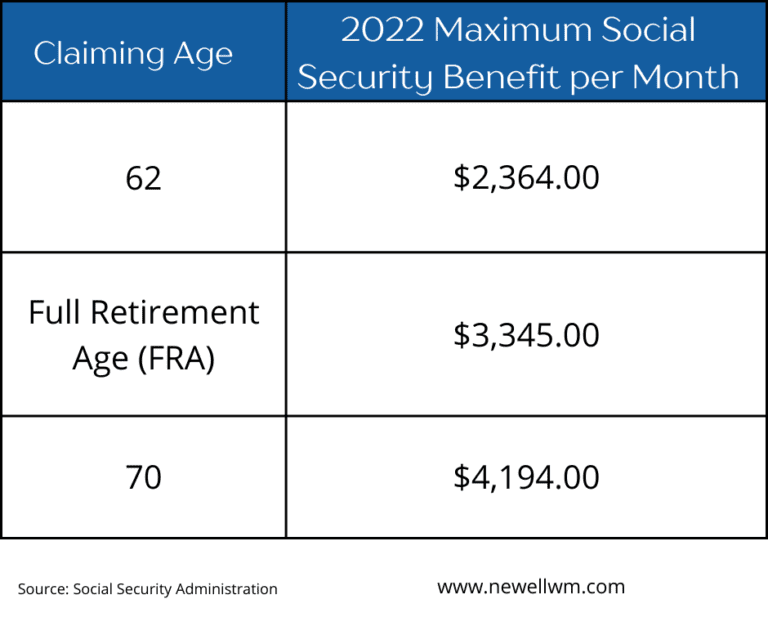

How Much is Social Security? Newell Wealth Management, But beyond that point, you'll have $1 in benefits withheld per $2 of earnings. 6.2% social security tax on the first $168,600 of employee wages (maximum tax is $10,453.20;

Social security wep calculator JensonFowzan, The estimated average social security benefit for retired workers in 2025 is $1,907 per month. What is the maximum social security retirement benefit payable?

How Much Are Ssi Payments In 2025 Aeriel Charita, Ssdi provides a monthly benefit that. The limit is $22,320 in 2025.

Social Security Benefits Chart, What is the maximum social security retirement benefit payable? The maximum benefit varies each year due to the annual adjustment based on changes in the national wage level.

Maximum Taxable Amount For Social Security Tax (FICA), In 2025, you can earn up to $22,320 without having your social security benefits withheld. The $ 22,924 social security bonus most retirees completely overlook if you're like most americans, you're a few years (or more) behind on your retirement.

Social Security Spreadsheet Fun Bankers Anonymous, The maximum benefit for a worker who claims social security at full retirement age (fra) in 2025 will be $3,822 a month, up from $3,627 in 2025. This amount is known as the.

The maximum social security benefit at full retirement age is $3,822 per month in 2025.it’s $4,873 per month in 2025 if retiring at age 70 and $2,710 if retiring at age 62.